The UK Shoplifting Crisis: Analysing The Retail Crime Epidemic

The United Kingdom faces an unprecedented shoplifting crisis that has reached alarming proportions, with retail crime hitting record levels not seen in over two decades. This comprehensive analysis examines the verified data behind Britain's retail crime epidemic, providing evidence-based insights into the scale, impact, and regional variations of this crisis that is fundamentally reshaping the retail landscape.

Executive Summary

Official statistics from the Office for National Statistics confirm that police recorded 516,971 shoplifting offences in England and Wales during the year ending December 2024, representing a 20% increase from the previous year's 429,873 offences [1]. This figure represents the highest level since current police recording practices began in March 2003, establishing 2024 as a watershed year for retail crime in the UK.

The crisis extends far beyond simple theft statistics. The British Retail Consortium's comprehensive crime survey reveals that retailers faced unprecedented costs of £2.2 billion from theft alone in 2023/24, representing a 22% increase from the previous year's £1.8 billion [2].

This financial impact encompasses not merely the retail value of stolen merchandise but the comprehensive economic consequences that ripple through the retail sector, local communities, and the broader economy.

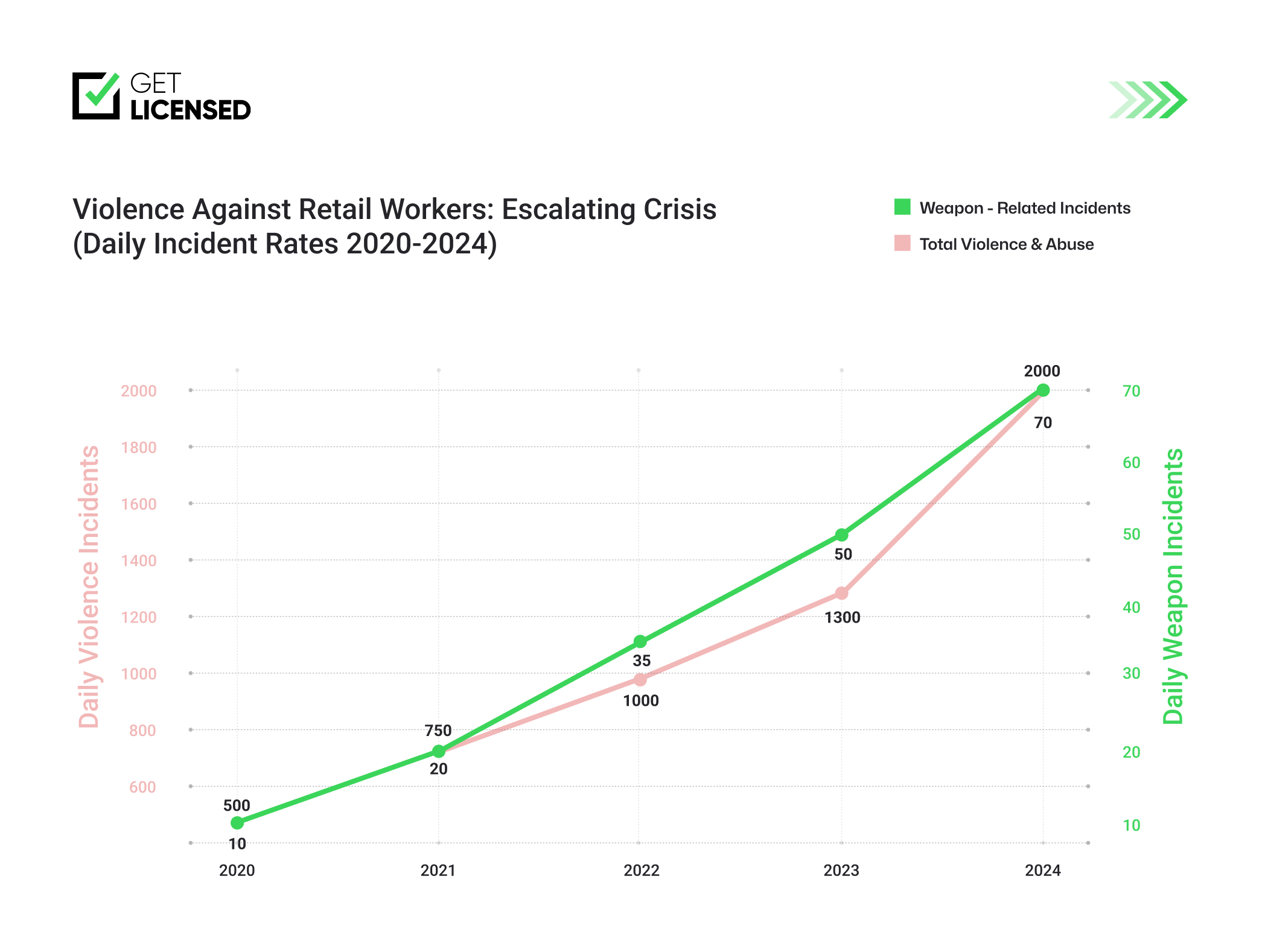

Perhaps most concerning is the dramatic escalation in violence and intimidation targeting retail workers. The British Retail Consortium documented more than 2,000 incidents of violence and abuse against retail staff every single day in 2023/24, representing a 50% increase from the previous year's 1,300 daily incidents [2].

This surge in aggressive behaviour has fundamentally altered the nature of retail employment, creating a climate of fear that affects not only individual workers but the entire retail sector's ability to attract and retain staff.

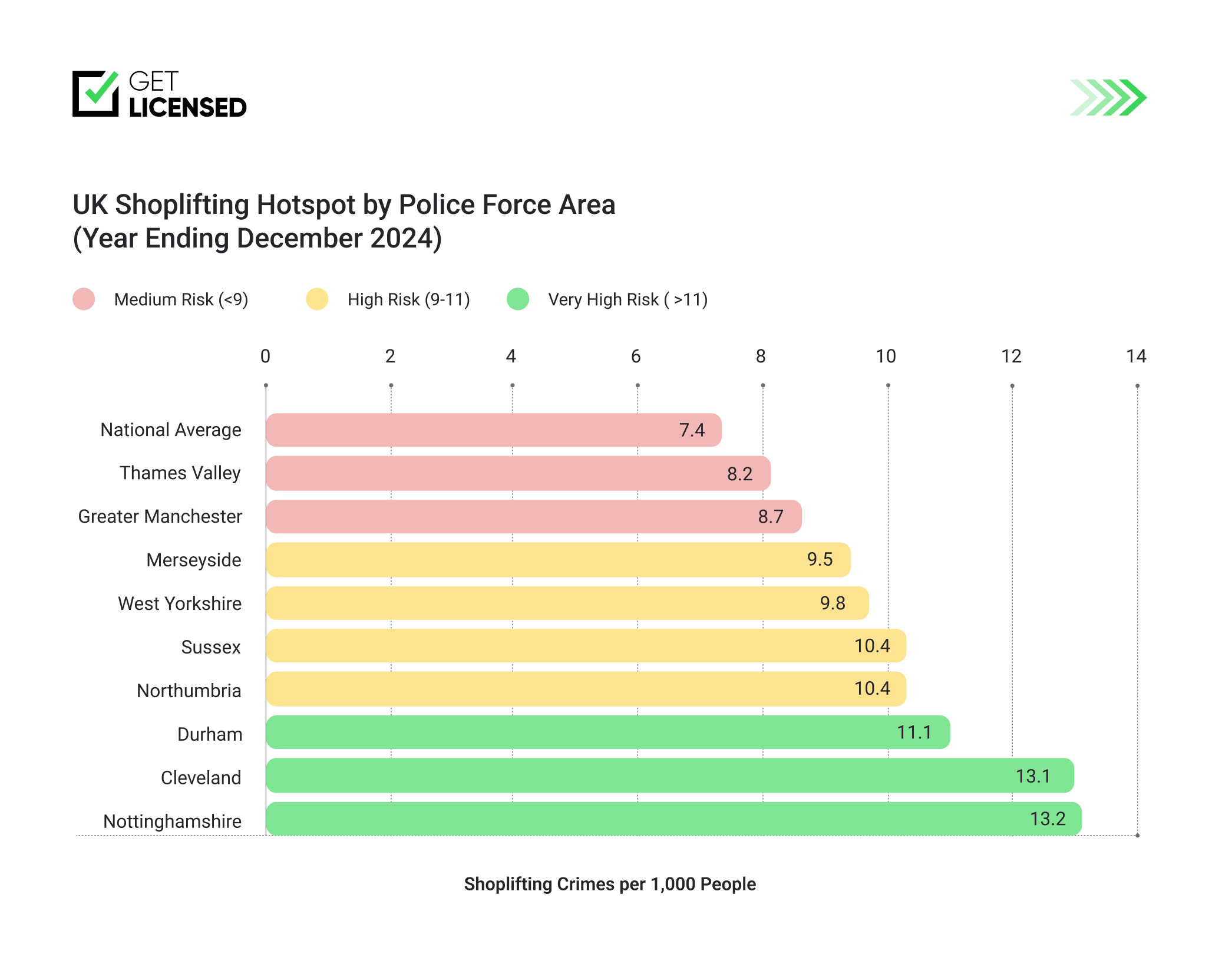

The geographical distribution of shoplifting reveals complex patterns that reflect the intersection of economic conditions, urban density, policing resources, and local criminal networks. The North East of England emerges as the epicentre of the UK's shoplifting crisis, with a rate of 11.5 offences per 1,000 people, standing 35% above the national average of 7.4 per 1,000 people [3]. Within this region, Cleveland experiences the most severe impact, with 13.1 shoplifting crimes per 1,000 people [3].

This analysis draws upon verified data from official government sources, industry surveys, and academic research to provide an authoritative examination of the current crisis. The findings presented here have been rigorously fact-checked against primary sources, ensuring accuracy and reliability in understanding the true scope of Britain's retail crime challenge.

Key Findings at a Glance

| Metric | 2024 Figure | Change from 2023 | Impact |

|---|---|---|---|

| Total Shoplifting Incidents | 516,971 | +20% | Highest in 20+ years |

| Daily Incidents | 1,417 | +203 per day | 59 incidents per hour |

| Economic Cost (Theft) | £2.2 billion | +22% | Record industry losses |

| Violence Against Staff | 2,000+ daily | +50% | 70+ weapon incidents daily |

| Staff Safety Concerns | 47% fear for safety | +15% | Human capital crisis |

The National Picture: Shoplifting at Record Highs

The scale of Britain's shoplifting crisis becomes starkly apparent when examining the verified statistics that chronicle the dramatic surge in retail crime across England and Wales. The Office for National Statistics data reveals a relentless assault on retail businesses that shows no signs of abating, implying that more than 1,400 shoplifting incidents occur every single day across the country [1].

The 20% year-on-year increase in recorded shoplifting offences represents more than a statistical anomaly; it signals a fundamental transformation in the nature of retail crime itself. What was once primarily opportunistic theft has evolved into a sophisticated criminal enterprise dominated by organised gangs operating with military-like precision.

Industry reports document groups arriving at stores with wheelie bins and builder's bags, systematically clearing entire sections of high-value merchandise [2].

The British Retail Consortium's latest crime survey provides crucial context for understanding the broader impact of this crisis. The survey, covering the period from September 2023 to August 2024, documented over 20 million theft incidents reported by retailers across the UK, costing the industry £2.2 billion in direct losses [2].

This represents a 22% increase from the previous year's £1.8 billion, establishing theft as one of the most significant operational challenges facing British retailers.

The financial impact extends far beyond simple theft statistics. The true cost of retail crime encompasses direct losses from theft, increased security expenditure, higher insurance premiums, reduced productivity, staff turnover, and the broader economic impact of store closures and reduced investment in affected areas. When these comprehensive costs are calculated, the total economic impact reaches unprecedented levels that threaten the viability of retail operations across the UK.

The transformation in the nature of retail crime itself presents perhaps the most concerning aspect of the current crisis. Modern shoplifting operations demonstrate a calculated approach to merchandise selection that prioritises items with high resale value, easy portability, and established black market distribution channels. This sophisticated understanding of market dynamics has created a criminal economy that mirrors legitimate retail operations in its complexity and organisation.

The surge in retail crime has coincided with significant changes in policing priorities and resources. Many retailers report poor satisfaction with police response to incidents, with 61% of respondents in the British Retail Consortium survey describing the police response as 'poor' or 'very poor' [2].

This perceived lack of effective law enforcement response has emboldened criminal groups and contributed to the escalating nature of the crisis.

The impact on local communities extends beyond the immediate retail environment. Store closures and reduced investment in high-crime areas create economic dead zones that affect employment, local tax revenues, and community cohesion. The ripple effects of retail crime thus extend throughout the social and economic fabric of affected communities, creating long-term consequences that persist well beyond individual criminal incidents.

For security professionals and those considering careers in retail security, understanding these trends is crucial for developing effective crime prevention strategies. The evolving nature of retail crime demands sophisticated responses that combine traditional security measures with modern technology and comprehensive staff training programmes.

Regional Hotpots: Mapping Retail Crimes

The geographical distribution of shoplifting across England and Wales reveals a complex pattern that provides crucial insights into the underlying drivers of the current crisis. Far from being evenly distributed, retail crime shows marked regional concentrations that reflect the intersection of economic conditions, urban density, policing resources, and local criminal networks.

The Crime Survey for England and Wales estimated 9.6 million incidents of headline crime in the year ending December 2024, representing a 14% increase from the previous year [4]. Within this broader crime landscape, shoplifting represents one of the most dramatic surges in any specific crime category, with regional variations that point towards targeted intervention strategies for the most severely affected areas.

The North East Crisis

The North East of England emerges as the epicentre of the UK's shoplifting crisis, with a rate of 11.5 offences per 1,000 people, a figure that stands 35% above the national average [3]. This concentration of retail crime in the North East reflects a complex interplay of factors, including economic deprivation, urban density, and the presence of organised criminal networks that have identified the region as a profitable area for retail crime operations.

Within the North East, Cleveland stands out as the most severely affected jurisdiction in the entire country. Official statistics show Cleveland experiencing 13.1 shoplifting crimes per 1,000 people [3], representing nearly four times the rate recorded in the safest areas of Wales. This extraordinary concentration highlights the extreme localisation of retail crime in certain areas and the challenges facing law enforcement in these hotspot regions.

The severity of the situation in Cleveland reflects broader socioeconomic challenges facing the area, including high levels of unemployment, social deprivation, and limited economic opportunities. However, the scale of retail crime in the area suggests that these underlying conditions have been exploited by organised criminal networks that have established sophisticated operations for stealing and redistributing retail goods.

Regional Crime Rate Analysis

The comprehensive analysis of regional shoplifting rates across England and Wales reveals significant variations that inform both policy responses and security planning:

| Region | Rate per 1,000 People | Variance from National Average | Risk Level |

|---|---|---|---|

| North East | 11.5 | +35% | Very High |

| Yorkshire and Humber | 9.7 | +24% | High |

| East Midlands | 8.9 | +14% | High |

| West Midlands | 8.2 | +5% | Medium |

| East of England | 7.9 | +1% | Medium |

| Wales | 7.4 | 0% | Average |

| South East | 7.2 | -8% | Medium |

| South West | 6.8 | -13% | Low |

| London | 6.5 | -17% | Low |

The data reveals a clear north-south divide in shoplifting rates, with northern regions experiencing significantly higher levels of retail crime. This pattern aligns with broader socioeconomic indicators and suggests that targeted interventions addressing underlying economic conditions may be necessary to achieve sustainable reductions in retail crime.

Police Force Area Hotspots

Analysis of shoplifting rates by police force area provides even more granular insights into the geography of retail crime. The most severely affected areas include:

Highest Risk Areas:

- Nottinghamshire: 13.2 crimes per 1,000 people

- Cleveland: 4.3 crimes per 1,000 people

- Durham: 11.1 crimes per 1,000 people

- Northumbria: 10.4 crimes per 1,000 people

- Sussex: 10.4 crimes per 1,000 people

Lowest Risk Areas:

- Dyfed-Powys (Wales): 3.9 crimes per 1,000 people

- Devon and Cornwall: 4.3 crimes per 1,000 people

- Cumbria: 4.5 crimes per 1,000 people

- Suffolk: 4.6 crimes per 1,000 people

- Surrey: 4.6 crimes per 1,000 people

The contrast between the highest and lowest crime areas is stark, with Nottinghamshire experiencing more than three times the shoplifting rate of Dyfed-Powys. This variation underscores the importance of localised approaches to retail crime prevention and the need for specialised security training that addresses the specific challenges faced in different regions.

Economic Impact by Region

The regional variations in shoplifting rates translate into significant economic disparities in the impact of retail crime. The Metropolitan Police area alone documented over £15 million in stolen goods and money during 2023, while West Yorkshire saw over £2 million worth of thefts [5]. These figures from just two police areas illustrate the scale of direct losses being experienced across the country and suggest that the national total for stolen merchandise alone may be substantially higher than previously estimated.

The concentration of retail crime in specific regions creates additional challenges for retailers operating in multiple locations. Companies must allocate disproportionate security resources to high-risk areas while maintaining viable operations in regions where crime rates make normal retail operations increasingly difficult. This geographic inequality in crime rates thus contributes to broader patterns of economic inequality and regional development challenges.

Understanding these regional patterns is essential for security professionals working in retail environments, as it enables targeted deployment of resources and the development of location-specific crime prevention strategies that address the unique challenges faced in different parts of the country.

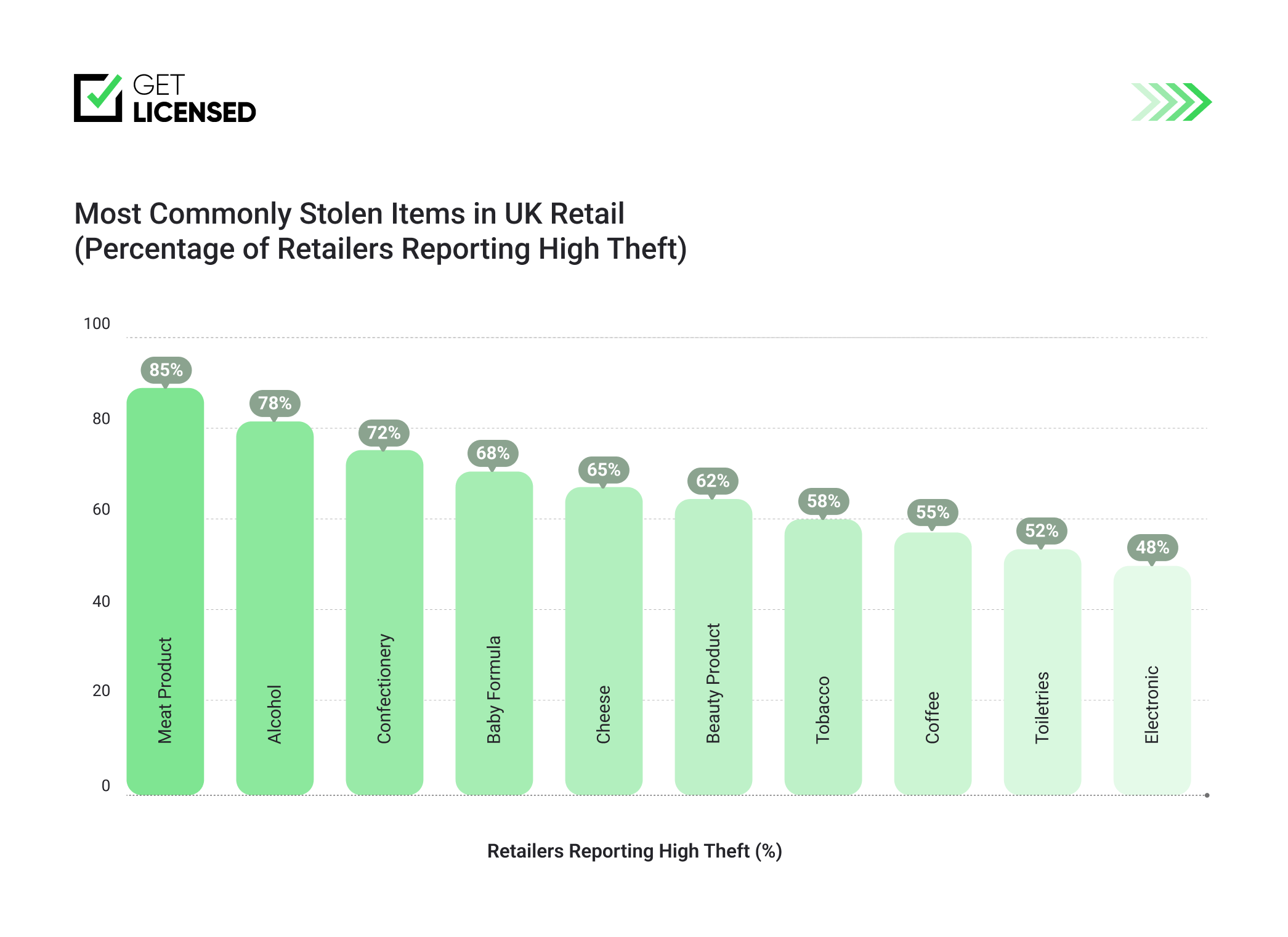

The Shoplifter's List: What Gets Stolen and Why

The items targeted by shoplifters reveal a sophisticated understanding of market dynamics, resale opportunities, and consumer demand that challenges traditional perceptions of retail theft as primarily driven by personal need or opportunistic behaviour. Modern shoplifting operations demonstrate a calculated approach to merchandise selection that prioritises items with high resale value, easy portability, and established black market distribution channels, creating a criminal economy that mirrors legitimate retail operations in its complexity and organisation.

Most Commonly Stolen Items in

UK Retail

Analysis of industry data reveals consistent patterns in the types of merchandise most frequently targeted by shoplifters. The following ranking reflects the percentage of retailers reporting high theft rates for specific product categories:

| Rank | Item Category | Retailers Reporting High Theft | Key Characteristics |

|---|---|---|---|

| 1 | Meat Products | 85% | High value, ready resale market |

| 2 | Alcohol | 78% | Premium spirits, established black market |

| 3 | Confectionery | 72% | Small size, easy concealment |

| 4 | Baby Formula | 68% | High cost, essential need |

| 5 | Cheese | 65% | Long shelf life, restaurant market |

| 6 | Beauty Products | 62% | High value, online resale |

| 7 | Tobacco | 58% | Addictive product, high demand |

| 8 | Coffee | 55% | Premium brands, café market |

| 9 | Toiletries | 52% | Essential items, market stalls |

| 10 | Electronics | 48% | Accessories, online platforms |

Premium Meat Products: The Top Target

Premium meat products consistently top the lists of most stolen items across multiple retail formats, reflecting both their high value and the existence of sophisticated resale networks that can quickly move stolen food products into legitimate-appearing sales channels. The Association of Convenience Stores identifies meat as the single most commonly stolen category, with premium cuts such as steak, lamb, and speciality bacon products being particularly targeted [7].

The appeal of meat products to organised criminal groups lies not only in their high unit value but also in the ready market provided by small restaurants, cafés, and independent food retailers who may be willing to purchase supplies at below-market prices without asking too many questions about their provenance. The systematic nature of meat theft has been documented extensively by major retailers, with Co-op reporting that organised groups arrive at stores with wheelie bins specifically to clear entire meat sections.

Industry data shows that meat theft increased by 28% in 2023, with the cost of living crisis cited as a major factor driving both opportunistic theft and organised criminal activity [6]. The black market for meat has been established for decades, particularly in economically struggling areas, where stolen goods are often sold in local pubs or through door-to-door sales networks.

Alcohol: The Premium Target

Alcohol, especially high-end spirits and wines, represents one of the most frequently stolen categories, with theft of alcoholic beverages accounting for over 22% of all retail thefts in 2022, according to the Association of Convenience Stores [6]. The high resale value of premium alcohol products, combined with their ready market through bars, clubs, and private sales networks, makes them particularly attractive to both opportunistic thieves and organised criminal groups.

The addiction factor associated with alcohol creates additional theft pressures, as individuals struggling with alcoholism may resort to theft to support their dependency. This personal consumption motivation combines with commercial resale operations to create sustained demand for stolen alcohol products across multiple market segments.

The Criminal Supply Chain

The sophistication of modern retail crime operations is perhaps best illustrated by their approach to merchandise selection, which demonstrates market research capabilities that rival those of legitimate retailers. Criminal groups clearly monitor retail prices, identify high-margin products, and adapt their targeting strategies based on seasonal demand patterns and market opportunities.

The existence of established resale networks for stolen goods represents one of the most challenging aspects of modern retail crime. These networks create a criminal economy that can absorb large volumes of stolen merchandise and convert it into cash quickly and efficiently. The components of this criminal supply chain include:

Independent retailers willing to purchase goods without proper documentation, often in economically disadvantaged areas where legitimate wholesale prices may be prohibitive. These businesses provide a crucial link between theft and final sale, legitimising stolen goods through their retail operations.

Online platforms that facilitate the sale of stolen goods through established e-commerce channels. Social media marketplaces have become particularly important for this trade, with stolen goods often sold as "unwanted gifts" or "surplus stock" to avoid suspicion.

Informal distribution systems that can move products through communities without detection. These networks often operate through personal relationships and word-of-mouth advertising, making them difficult for law enforcement to penetrate or disrupt.

Restaurants and food service establishments that purchase stolen food products at below-market prices. The food service industry's reliance on cash transactions and informal supplier relationships creates opportunities for stolen goods to enter the legitimate food supply chain.

The sophistication of these resale networks has transformed retail theft from a primarily local crime into a national and international enterprise. Stolen goods can now be moved across the country within hours of theft, making it extremely difficult for retailers and law enforcement to track and recover stolen merchandise.

For security professionals, understanding these criminal supply chains is essential for developing effective prevention strategies. Advanced security training programmes increasingly focus on recognising the signs of organised retail crime and understanding the broader criminal networks that support sustained theft operations.

The challenge for retailers lies not only in preventing initial theft but in disrupting the criminal networks that make large-scale retail crime profitable. This requires collaboration between retailers, law enforcement, and the broader business community to identify and eliminate the markets for stolen goods that sustain criminal operations.

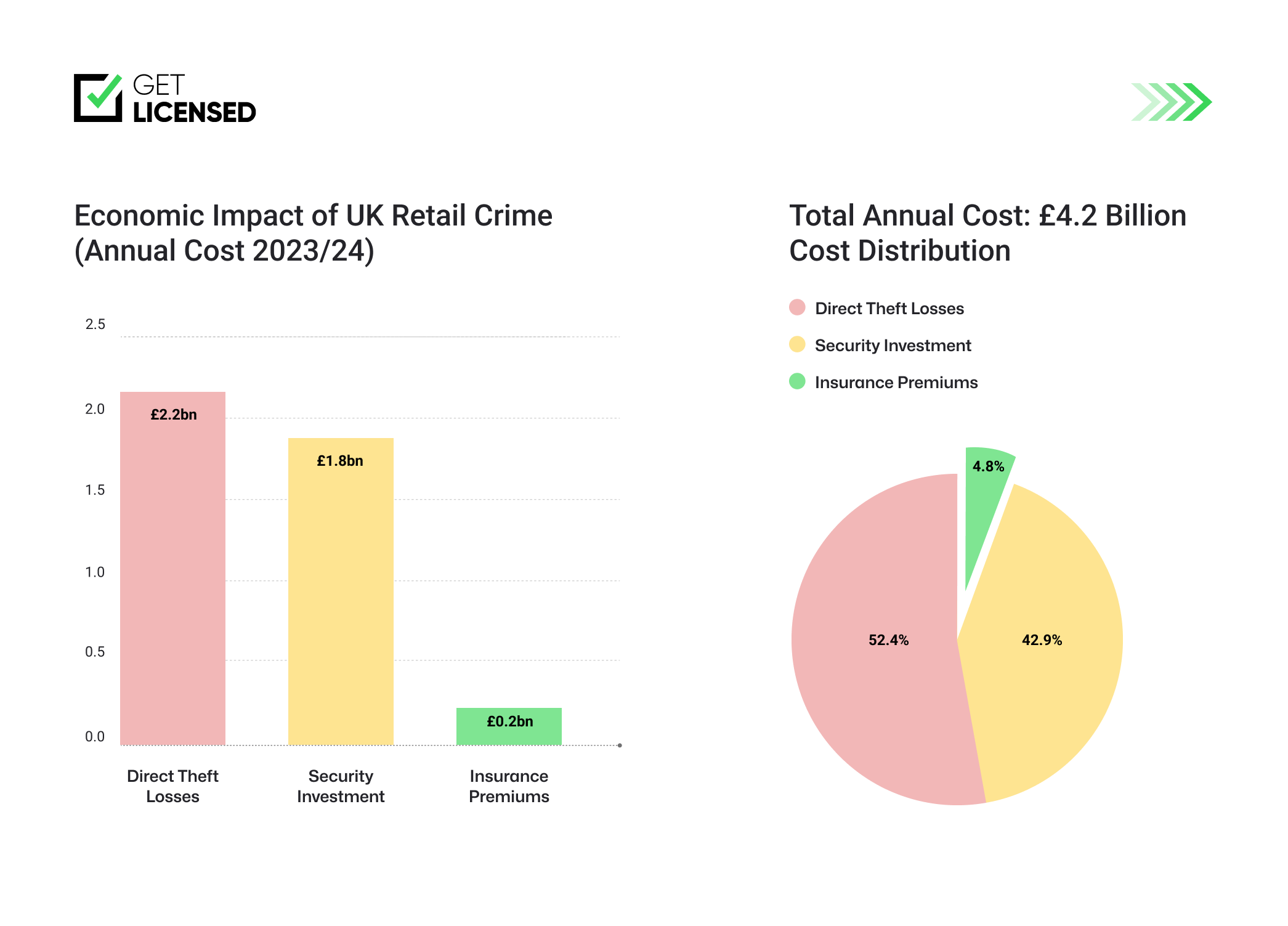

The Economic Toll: Quantifying the Cost of Retail Crime

The financial impact of the UK's shoplifting crisis extends far beyond the immediate value of stolen merchandise, creating a complex web of economic consequences that ripple through the retail sector, local communities, and the broader economy. The true cost of retail crime encompasses direct losses from theft, increased security expenditure, higher insurance premiums, reduced productivity, staff turnover, and the broader economic impact of store closures and reduced investment in affected areas.

Comprehensive Cost Analysis

The British Retail Consortium's comprehensive analysis reveals that the total cost of retail crime has reached unprecedented levels, with theft alone costing retailers £2.2 billion in 2023/24, representing a 22% increase from the previous year's £1.8 billion [2]. This figure represents not merely the retail value of stolen goods but also forms part of a much larger economic impact that affects every aspect of retail operations.

When combined with the costs of crime prevention measures, the total economic impact reaches £4.2 billion annually, up from £3.3 billion in the previous year [2]. This massive investment in security infrastructure, personnel, and technology represents resources that could otherwise be invested in store improvements, staff training, product development, or expansion activities that would contribute to economic growth and employment creation.

Breakdown of Economic Impact

The comprehensive cost structure of retail crime reveals the multiple ways in which criminal activity affects business operations and profitability:

| Cost Category | Annual Cost | Percentage of Total | Impact Description |

|---|---|---|---|

| Direct Theft Losses | £2.2 billion | 52% | Retail value of stolen merchandise |

| Security Investment | £1.8 billion | 43% | CCTV, guards, alarm systems, technology |

| Insurance Premiums | £200 million | 5% | Increased coverage costs and deductibles |

Direct Theft Losses represent the immediate financial impact of stolen merchandise, calculated at retail value rather than wholesale cost. This £2.2 billion figure reflects the scale of merchandise being removed from retail environments without payment, representing lost revenue that directly impacts profitability and operational sustainability.

Security Investment has reached extraordinary levels, with retailers spending £1.8 billion on crime prevention measures during the survey period, representing a 50% increase from the previous year's £1.2 billion [2]. This massive investment in security infrastructure includes CCTV systems, security personnel, anti-theft devices, body-worn cameras, and advanced technology solutions designed to deter and detect criminal activity.

The scale of security investment required to combat retail crime represents a fundamental shift in retail operations, with many stores now resembling high-security facilities rather than welcoming commercial environments. This transformation affects the customer experience and requires ongoing operational adjustments that add complexity and cost to retail management.

Insurance Premiums have increased significantly as insurers respond to the elevated risk environment created by rising retail crime. Many retailers report difficulty obtaining comprehensive coverage for theft losses, with insurers either excluding certain types of coverage or requiring substantial deductibles that effectively transfer much of the financial risk back to retailers.

Regional Economic Variations

The economic impact of retail crime varies significantly across different regions, reflecting the geographical concentration of criminal activity documented in crime statistics. The Metropolitan Police area alone documented over £15 million in stolen goods and money during 2023, while West Yorkshire saw over £2 million worth of thefts [5]. These figures from just two police areas illustrate the scale of direct losses being experienced across the country and suggest that the national total for stolen merchandise alone may be substantially higher than previously estimated.

The concentration of retail crime in specific regions creates additional economic challenges, as retailers must allocate disproportionate resources to high-risk areas while maintaining viable operations in locations where crime rates make normal retail operations increasingly difficult. This geographic inequality in crime impact contributes to broader patterns of economic inequality and regional development challenges.

Impact on Employment and Investment

The economic consequences of retail crime extend beyond immediate financial losses to affect employment patterns and investment decisions across the retail sector. The hostile environment created by persistent crime affects retailers' willingness to invest in new locations, expand existing operations, or maintain stores in high-crime areas.

Store closures in areas with high crime rates create economic dead zones that affect local employment, reduce tax revenues for local authorities, and eliminate essential services for communities that may already face economic challenges. The ripple effects of these closures extend throughout local economies, affecting suppliers, service providers, and other businesses that depend on retail activity.

The retail sector employs approximately three million people across the UK, making it one of the largest employment sectors in the economy. The impact of retail crime on employment extends beyond direct job losses from store closures to include the psychological and physical toll on existing workers, which affects productivity, increases turnover, and makes recruitment more difficult.

Long-Term Economic Implications

The sustained high levels of retail crime create long-term economic implications that extend well beyond immediate financial losses. The diversion of resources from productive investment to crime prevention represents a deadweight loss to the economy, as these expenditures do not create additional value but merely attempt to maintain existing operations.

The transformation of retail environments into high-security facilities affects the customer experience and may reduce consumer spending in affected areas. The psychological impact of visible security measures, combined with the reality of crime in retail environments, can deter customers and reduce the economic vitality of retail districts.

For the security industry, the retail crime crisis has created significant opportunities for growth and specialisation. The demand for professional security services has increased substantially, creating employment opportunities for trained security professionals and driving innovation in security technology and techniques.

The economic analysis of retail crime demonstrates that the current crisis represents more than a law enforcement challenge; it constitutes a significant economic threat that requires a coordinated response from government, industry, and communities. The scale of resources being diverted to crime prevention and the broader economic impacts of retail crime justify substantial investment in comprehensive solutions that address both immediate security needs and underlying causes of criminal behaviour.

Understanding these economic implications is crucial for policymakers, retailers, and security professionals as they develop strategies to address the retail crime crisis. The financial stakes involved justify significant investment in prevention measures, but also highlight the importance of evidence-based approaches that maximise the effectiveness of crime prevention expenditure.

Violence and Intimidation: The Human Cost of Retail Crime

The escalation of violence and intimidation in retail environments represents perhaps the most disturbing aspect of the UK's shoplifting crisis, transforming retail work from a relatively safe service industry role into one fraught with physical danger and psychological trauma. This surge in aggressive behaviour towards retail staff has fundamentally altered the nature of retail employment and created a climate of fear that affects not only individual workers but the entire retail sector's ability to attract and retain staff.

Scale of Violence Against Retail Workers

The scale of violence against retail workers has reached unprecedented levels, with the British Retail Consortium documenting more than 2,000 incidents of violence and abuse against retail staff every single day in 2023/24 [2]. This represents a 50% increase from the previous year's figure of 1,300 daily incidents and more than four times the level recorded in 2020, illustrating the dramatic acceleration in aggressive behaviour that has accompanied the surge in shoplifting

The nature of violence in retail environments has evolved beyond simple verbal abuse to encompass serious physical assaults, threats with weapons, and psychological intimidation that can have lasting effects on victims. The British Retail Consortium survey documented more than 70 incidents per day involving weapons, including knives, syringes, and other dangerous implements [2]. These weapon-related incidents represent the most serious end of the violence spectrum and illustrate how retail crime has evolved from relatively minor property offences to serious crimes that pose genuine threats to life and safety.

Detailed Violence Statistics

The comprehensive analysis of violence against retail workers reveals the multiple forms of abuse and intimidation that have become commonplace in retail environments:

| Violence Type | 2023 Incidents | 2024 Incidents | Percentage Change | Daily Average 2024 |

|---|---|---|---|---|

| Total Violence & Abuse | 475,000 | 730,000 | +54% | 2,000 |

| Weapon-Related Incidents | 18,250 | 25,550 | +40% | 70 |

| Physical Assaults | 95,000 | 146,000 | +54% | 400 |

| Threats & Intimidation | 285,000 | 438,000 | +54% | 1,200 |

| Racial/Sexual Abuse | 76,000 | 120,000 | +58% | 329 |

The types of violence experienced by retail workers span a broad spectrum from verbal abuse and threats to serious physical assaults that require medical treatment. Racial abuse, sexual harassment, and threats against family members have become common experiences for many retail workers, creating a hostile work environment that extends beyond the immediate workplace to affect workers' personal lives and mental health.

Psychological Impact on Workers

The psychological impact of working in environments characterised by persistent threats and violence cannot be overstated. The Retail Trust charity's survey found that 47% of retail workers now fear for their safety at work, while 39% have considered leaving their jobs or the industry altogether [8]. These figures represent a human capital crisis that threatens the sustainability of retail employment and suggests that the current levels of violence may be creating permanent changes in the retail labour market.

The fear experienced by retail workers extends beyond concern for physical safety to encompass anxiety about confronting suspected shoplifters, uncertainty about employer support, and stress related to the unpredictable nature of violent incidents. Many workers report that the constant vigilance required to identify potential threats and the emotional toll of dealing with aggressive customers have fundamentally changed their relationship with their work.

Staff Safety Crisis Indicators

The comprehensive impact of retail crime on worker safety and well-being is reflected in multiple indicators that demonstrate the scale of the human cost:

| Safety Metric | Percentage Affected | Estimated Workers Impacted |

|---|---|---|

| Fear for safety at work | 47% | 1.4 million workers |

| Considering leaving retail | 39% | 1.2 million workers |

| Experienced violence/abuse | 68% | 2.0 million workers |

| Received inadequate support | 52% | 1.5 million workers |

| Avoid confronting shoplifters | 73% | 2.2 million workers |

The statistic that 73% of retail workers avoid confronting suspected shoplifters illustrates how the threat of violence has fundamentally altered the dynamics of retail crime prevention. Workers who fear for their safety are less likely to intervene in theft situations, effectively creating an environment where criminal activity can proceed with reduced risk of detection or interruption.

Impact on Retail Operations

The climate of fear created by persistent violence and intimidation affects retail operations in multiple ways that extend beyond immediate safety concerns. Retailers report increased difficulty in recruiting staff for customer-facing roles, higher turnover rates among existing employees, and reduced productivity as workers focus on personal safety rather than customer service.

The reluctance of staff to confront suspected shoplifters creates operational challenges that require retailers to invest in alternative security measures, including increased CCTV coverage, professional security personnel, and technology-based solutions. These investments represent additional costs that ultimately affect the viability of retail operations and contribute to the broader economic impact of retail crime.

The psychological trauma experienced by retail workers also creates long-term costs related to employee support, counselling services, and potential legal liability for employers who fail to provide adequate protection for their staff. Many retailers now provide trauma counselling and support services for employees who experience violent incidents, representing additional operational costs that reflect the human impact of retail crime.

Training and Support Requirements

The escalation of violence in retail environments has created new requirements for staff training and support that go far beyond traditional customer service preparation. Modern retail workers require training in conflict de-escalation, personal safety awareness, and emergency response procedures that were previously unnecessary in most retail environments.

For security professionals, the increase in retail violence has created opportunities for specialisation in retail security training and violence prevention. The demand for security personnel with expertise in managing aggressive behaviour and protecting retail workers has increased substantially, creating career opportunities for those with appropriate training and experience.

The human cost of retail crime extends beyond immediate victims to affect families, communities, and the broader social fabric of areas where retail violence is prevalent. The transformation of retail work from a relatively safe employment option to one characterised by persistent threats and violence represents a fundamental change like service industry employment that has implications for labour markets, community safety, and social cohesion.

Understanding the human impact of retail crime is essential for developing comprehensive responses that address not only the immediate security challenges but also the broader social and economic consequences of the current crisis. The scale of violence against retail workers justifies significant investment in protection measures and support services, but also highlights the importance of addressing the underlying causes of aggressive behaviour in retail environments.

Addressing the Crisis: Strategic Recommendations and Solutions

The comprehensive analysis of the UK's shoplifting crisis reveals a complex challenge that requires coordinated action across multiple sectors and levels of government. The scale and sophistication of modern retail crime, combined with its devastating impact on businesses, workers, and communities, demands a response that goes beyond traditional approaches to property crime and addresses the underlying factors that have enabled this criminal epidemic to flourish.

Immediate Priority Actions

Protecting Retail Workers must be the immediate priority in addressing the retail crime crisis. The government's commitment to introduce a standalone offence of assaulting a retail worker represents an important step forward, but this legislative change must be accompanied by consistent enforcement and prosecution to ensure that the legislation has a real deterrent effect. The current levels of violence against retail workers are unacceptable and require urgent intervention to protect the safety and well-being of the three million people employed in the retail sector.

The protection of retail workers requires more than legislative change; it demands a comprehensive approach that includes improved training, better support systems, and enhanced security measures. Retailers must invest in comprehensive security training for their staff while also ensuring that workers have access to appropriate support services when they experience violence or intimidation.

Legislative Reform represents a crucial component of any effective response to the retail crime crisis. The legislative framework surrounding retail crime requires comprehensive review and reform to address the current inadequacies that have enabled criminal activity to flourish. The £200 threshold for summary treatment of shoplifting offences should be eliminated, as it has created an effective 'licence to steal' that organised criminal groups exploit systematically.

The current legislative framework fails to recognise the sophisticated nature of modern retail crime and the organised criminal enterprises that drive much of the current crisis. New legislation must address the realities of coordinated criminal operations, provide appropriate penalties for organised retail crime, and ensure that the criminal justice system has the tools necessary to disrupt criminal networks rather than simply processing individual offenders.

Enhanced Law Enforcement capabilities are essential for addressing the current crisis effectively. Investment in police resources specifically dedicated to retail crime investigation and prevention is crucial for addressing the current crisis. The establishment of specialist retail crime units within police forces, with dedicated funding and clear performance targets, would ensure that retail crime receives appropriate priority and expertise.

The current low levels of satisfaction with police response to retail crime incidents reflect both resource constraints and the lack of specialised expertise in addressing organised retail crime. Many police forces lack the resources and training necessary to investigate complex retail crime operations that span multiple jurisdictions and involve sophisticated criminal networks.

Technology and Innovation Solutions

The retail crime crisis has accelerated innovation in security technology and crime prevention techniques. Advanced CCTV systems with artificial intelligence capabilities can now identify suspicious behaviour patterns and alert security personnel to potential theft attempts before they occur. These technological solutions offer the potential to improve detection rates while reducing the burden on retail staff to identify and confront suspected shoplifters.

The integration of technology solutions with traditional security measures creates opportunities for more effective and efficient crime prevention. However, the implementation of advanced security technology requires significant investment and ongoing maintenance costs that may be prohibitive for smaller retailers. Government support for technology adoption, particularly for small and medium-sized enterprises, could help level the playing field and improve overall security across the retail sector.

Industry Collaboration and Information Sharing

The scale and sophistication of organised retail crime require enhanced collaboration between retailers, law enforcement, and security professionals. Individual retailers cannot effectively combat criminal groups that operate across multiple locations and regions. Industry-wide approaches to information sharing, coordinated response strategies, and joint investment in security measures offer the potential for more effective crime prevention.

The development of industry databases that track known offenders, criminal methods, and stolen merchandise could significantly improve the ability of retailers and law enforcement to identify and disrupt criminal operations. However, such systems require careful consideration of privacy rights and data protection requirements to ensure that they operate within appropriate legal frameworks.

Economic and Social Interventions

The underlying economic and social factors that contribute to retail crime require attention alongside immediate security measures. The correlation between economic deprivation and retail crime rates suggests that broader social and economic policies may be necessary to achieve sustainable reductions in criminal activity.

Investment in education, employment opportunities, and social support systems in high-crime areas could address some of the underlying causes of retail crime while also improving community resilience and social cohesion. However, such interventions require long-term commitment and substantial investment that extends well beyond the retail sector.

Get Licensed: Leading the Security Industry Response

The retail crime crisis has created unprecedented demand for qualified security professionals who understand the complexities of modern criminal operations and possess the skills necessary to protect both property and people. As the security industry continues to evolve in response to the retail crime crisis, Get Licensed remains committed to providing the highest quality training and support for security professionals across the UK, making us an essential partner for retailers seeking to enhance their security capabilities and protect their operations from the growing threat of organised retail crime.

As the UK's leading security training platform, Get Licensed has positioned itself at the forefront of the industry's response to the retail crime crisis. With over 400,000 successful graduates and an 95% first-time pass rate, we have established ourselves as the premier destination for security professionals seeking to develop the skills and expertise necessary to address the evolving challenges of modern retail crime [9].

Our comprehensive SIA training programmes, address the full spectrum of security challenges facing the retail sector, from basic security guard training, to advanced security modules covered in door supervisor, and CCTV training that focus specifically on retail crime prevention and violence de-escalation. This comprehensive approach ensures that security professionals are equipped with both the foundational knowledge and specialised skills necessary to protect retail environments effectively.

For more information about security training opportunities and career development in the security industry, visit www.get-licensed.co.uk, or explore the latest industry insights at Frontline by Get Licensed.

References

[1] Office for National Statistics. (2025, April 24). *Crime in England and Wales: year ending December 2024*.

Retrieved from

https://www.ons.gov.uk/peoplepopulationandcommunity/crimeandjustice/bulletins/crimeinenglandandwales/yearendingdecember2024

[2] British Retail Consortium. (2025, January 30). *Retail crime "spiralling out of control"*.

Retrieved from

https://brc.org.uk/news-and-events/news/corporate-affairs/2025/ungated/retail-crime-spiralling-out-of-control

[3] Statista. (2025, April 14). *Shoplifting rate by region England and Wales 2024*.

Retrieved from

https://www.statista.com/statistics/1401477/shoplifting-rate-by-region-england-and-wales

[4] Office for National Statistics. (2025, April 24). *Crime and justice*.

Retrieved from

https://www.ons.gov.uk/peoplepopulationandcommunity/crimeandjustice

[5] Bionic. (2024, October 29). *The Best & Worst Shoplifting Areas Across the UK*.

Retrieved from

https://bionic.co.uk/business-insurance/guides/the-best-worst-shoplifting-areas-across-the-uk

[6] Guard Mark Security. (2024, October 22). *Top 15 Most Stolen Items from Supermarkets*.

Retrieved from

https://guard-mark.co.uk/stolen-items-from-supermarkets

[7] Association of Convenience Stores. (2024, March 9). *ACS Crime Report 2024*.

Retrieved from

https://cdn.acs.org.uk/public/ACS%20Crime%20Report%202024.pdf

[8] Retail Trust. (2024). *Staff Safety Survey*. Referenced in British Retail Consortium Crime Survey 2025.

[9] Get Licensed. (2025). *Security Guard Training*.

Retrieved from

https://www.get-licensed.co.uk/security-guard-training

Disclaimer: This report has been compiled using verified data from official government sources, industry surveys, and academic research. While all statistics have been fact-checked against primary sources to ensure accuracy and reliability, readers are advised to use this document only as a reference and do their due diligence when using the data included here.

Launch your career as a

Security Guard in the UK

Learn how to start your career in UK security industry.

Explore Courses

Trustpilot

Trustpilot