How to do your VAT registration

You may need a VAT registration when your turnover from your activities exceeds the VAT registration threshold, or where you expect that your turnover will exceed the VAT registration threshold. This can happen when your income from activities exceeds the registration threshold, detailed below. Please note, this includes services bought from abroad where relevant and will include all your earnings.

If you’re new to VAT this page walks you through the basics of the registration process. Expect the registration to take a minimum of 1 week.

The information on this page does not constitute tax advice. Consult a tax advisor for more details on criteria and requirements that apply to you.

What your registration entails

VAT on the earnings you make

The VAT you collect from selling your services is payable to HMRC with your VAT return.

VAT on business expenses

Besides collecting VAT, you may also be charged VAT on your business expenditure. For example fuel and car repairs. When you are VAT registered, you may be able to deduct this from the VAT you collected, but be sure to keep copies of your VAT invoices/receipts.

HMRC has helpful sites, such as this one, to help you better understand what you can recover.

Criteria and Requirements

How to get started

If your annual turnover, from all business activities, exceeds the threshold of £85,000, you are obliged to apply for a VAT registration. If your annual turnover is less than £85,000, you automatically fall below the VAT registration threshold, but you can voluntarily register for VAT if you wish.

When you expect your annual turnover to exceed the threshold, but be less than £150,000, you can apply for the Flat Rate Scheme. More, high level, information on the different types of VAT registrations will follow below.

If you want to know more on how and when to register, please visit this UK Government website, which contains some useful information.

Other regimes

Below the VAT registration threshold of £85,000 per year

As mentioned above, you fall below the VAT registration threshold when your annual turnover is less than £85,000. This means that:

- You should not be required to register for UK VAT

- No UK VAT should fall due on the services provided by you

- You cannot reclaim input VAT incurred on business expenses that continue to be payable by you even when you are not VAT registered

Flat Rate Scheme

When you are registered for VAT and your annual turnover is less than £150,000, you can apply to join the Flat Rate Scheme (you can apply either when you first register for VAT or at a later date).

Under the Flat Rate Scheme you pay a fixed rate of VAT to HMRC instead. On transportation services, this amounts to 10% of your total turnover. In the first VAT-registered year, you receive a discount and can therefore reduce this rate by 1%.

Once you are registered and using the Flat Rate Scheme you are, amongst other things:

- Required to charge VAT at a rate of 20% on all services you provide.

- Not entitled to claim input VAT on your local business expenses, except for certain capital expenditures

- Required to remit 10% of your VAT inclusive turnover to HMRC

The above is not a comprehensive list of your tax compliance requirements, but this system can save you a lot of time and effort, since the recording of VAT is much more simple. More information can be found on this website. We would also suggest speaking with a tax professional.

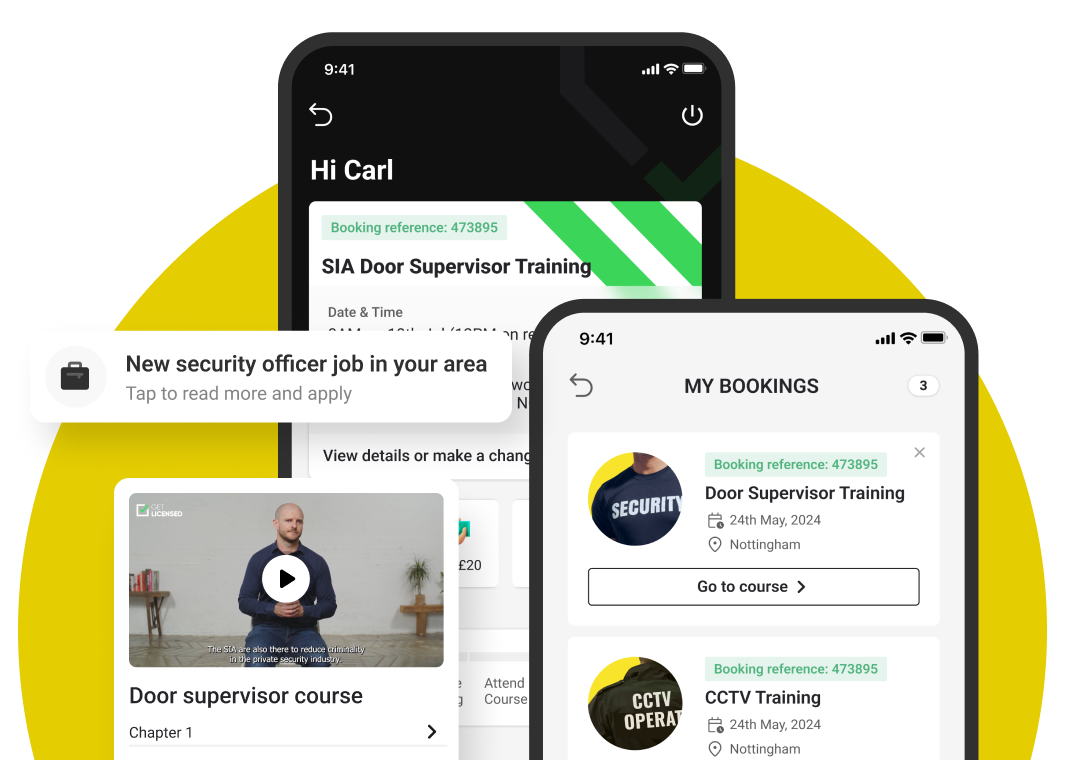

Your Get Licensed profile

Make sure you update your tax information via the Get Licensed Partner App

General VAT regime

Be sure to provide us with a valid VAT-number (by adding it to your Tax Profile / Invoice Settings page).

Flat Rate Scheme

Be sure to provide us with a valid VAT-number (by adding it to your Tax Profile / Invoice Settings page).

Also, if your VAT registration details change at any time, please remember to update your tax profile too!

Frequently asked questions

You'll be able to download a statement from your Partner Portal

Trustpilot

Trustpilot